This is a rather important topics for anyone interested in doing Finance.

Lets look at their definition first.

A Martingale is a random process ![]() with respect to the information filtration

with respect to the information filtration ![]() and the probability distribution

and the probability distribution ![]() , if

, if

![]() for all

for all ![]()

![]() for all

for all ![]()

Martingales are used widely and one example is to model fair games, thus it has a rich history in modelling of gambling problems. If you google Martingale, you will get an image related to a Horse, because it started with Horse-betting.

We define a submartigale by replacing the above condition 2 with

![]() for all

for all ![]()

and a supermartingale with

![]() for all

for all ![]() .

.

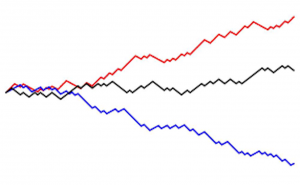

Take note that a martingale is both a submartingale and a supermartingale. Submartingale in layman terms, refers to the player expecting more as time progresses, and vice versa for supermartingale.

Let us try to construct a Martingale from a Random Walk now.

Let ![]() be a random walk where the

be a random walk where the ![]() ’s are IID with mean

’s are IID with mean ![]() .

.

Let ![]() . Then

. Then ![]() is a martingale because:

is a martingale because:

![]()

![]()

![]() since expectation distributes linearly

since expectation distributes linearly

![]()

![]()

So how will a martingale betting strategy be like?

Here, we let ![]() be IID random variables with

be IID random variables with ![]() . We can imagine

. We can imagine ![]() to represent the result of a coin-flipping game where,

to represent the result of a coin-flipping game where,

– player win ![]() latex X_i = 1

latex X_i = 1![]() 1 if the coin comes up tails, that is,

1 if the coin comes up tails, that is, ![]()

Consider further now a doubling strategy where we keep doubling the bet until we eventually win. Once we win, we stop and our initial bet is ![]() latex n^{th}

latex n^{th}![]() latex 2^{n-1}

latex 2^{n-1}![]() latex W_n

latex W_n![]() latex W_0 = 0

latex W_0 = 0![]() latex W_n

latex W_n![]() latex W_n \in \{ 1, -2^n +1 \}

latex W_n \in \{ 1, -2^n +1 \}![]() latex n^{th}

latex n^{th}![]() latex W_n = -(1 + 2 + \ldots + 2^{n-2}) + 2^{n-1}latex = -(2^{n-1} – 1) + 2^{n-1} = 1

latex W_n = -(1 + 2 + \ldots + 2^{n-2}) + 2^{n-1}latex = -(2^{n-1} – 1) + 2^{n-1} = 1![]() latex W_n = -(1 + 2 + \ldots + 2^{n-1}) = -2^n +1

latex W_n = -(1 + 2 + \ldots + 2^{n-1}) = -2^n +1![]() latex W_n

latex W_n![]() latex \mathbb{E}[W_{n+1} | W_n] = W_n

latex \mathbb{E}[W_{n+1} | W_n] = W_n![]() latex W_n = 1

latex W_n = 1![]() latex P(W_{n+1} = 1 | W_n = 1) = 1

latex P(W_{n+1} = 1 | W_n = 1) = 1![]() latex \mathbb{E}[W_{n+1} | W_n = 1] = 1 = W_n

latex \mathbb{E}[W_{n+1} | W_n = 1] = 1 = W_n![]() latex W_n = -2^n +1

latex W_n = -2^n +1![]() latex 2^n

latex 2^n![]() latex (n+1)^{th}

latex (n+1)^{th}![]() latex W_{n+1} \in \{ 1 , -2^{n+1} + 1 \}

latex W_{n+1} \in \{ 1 , -2^{n+1} + 1 \}![]() latex P(W_{n+1} = 1) | W_n = -2^n +1) = \frac{1}{2}

latex P(W_{n+1} = 1) | W_n = -2^n +1) = \frac{1}{2}![]() latex P(W_{n+1} = -2^{n+1}+1 | W_n = -2^n +1) = \frac{1}{2}

latex P(W_{n+1} = -2^{n+1}+1 | W_n = -2^n +1) = \frac{1}{2}![]() latex \mathbb{E}[W_{n+1} | W_n = -2^n +1] = \frac{1}{2} \times 1 + \frac{1}{2} \times (-2^{n+1} +1) = -2^n + 1 = W_n

latex \mathbb{E}[W_{n+1} | W_n = -2^n +1] = \frac{1}{2} \times 1 + \frac{1}{2} \times (-2^{n+1} +1) = -2^n + 1 = W_n![]() latex \mathbb{E} [W_{n+1} | W_n] = W_n

latex \mathbb{E} [W_{n+1} | W_n] = W_n![]() latex X_n

latex X_n![]() latex P(X_{n+1} = k+1 | X_n = k) = \frac{k}{n + 2}latex P(X_{n+1} = k | X_n = k) = \frac{n + 2 – k}{n + 2}

latex P(X_{n+1} = k+1 | X_n = k) = \frac{k}{n + 2}latex P(X_{n+1} = k | X_n = k) = \frac{n + 2 – k}{n + 2}![]() latex M_n := \frac{X_n}{n+2}$ is a martingale.

latex M_n := \frac{X_n}{n+2}$ is a martingale.

[…] Introduction to Martingales […]