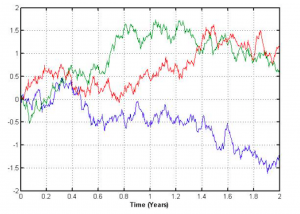

Lets look at brownian motion now. And yes, its the same as what our high school teachers taught about the particles moving in random motion. Here, we attempt to give it a proper structure and definition to work with.

A Brownian Motion is a random process ![]() with parameters

with parameters ![]() if

if

For ![]() ,

, ![]() are mutually independent. This is often called the independent increments property.

are mutually independent. This is often called the independent increments property.

For ![]()

![]() is a continuous function of t.

is a continuous function of t.

We say that ![]() is a

is a ![]() Brownian motion with drift

Brownian motion with drift ![]() and volatility

and volatility ![]() .

.

For the special case of ![]() and

and ![]() , we have a standard Brownian motion. We can denote it with

, we have a standard Brownian motion. We can denote it with ![]() and assume that

and assume that ![]()

If ![]() and

and ![]() then

then ![]() where

where ![]() is a standard brownian motion. Thus,

is a standard brownian motion. Thus, ![]()

The next concept is important in finance, that is, Information Filtrations.

For any random process, we will use ![]() to denote the information available at time t.

to denote the information available at time t.

– the set ![]() is then the information filtration.

is then the information filtration.

– ![]() denotes an expectation conditional on time t information available.

denotes an expectation conditional on time t information available.

Note: The independent increment property of Brownian Motion implies that any function of ![]() is independent of

is independent of ![]() and that

and that ![]() .

.

So let us do a bit of math to obtain ![]() for instance.

for instance.

Using condition expectation identity, we have

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

[…] Introduction to Brownian Motion – The Culture on Conditional Expectations and Variances […]

[…] the continuous-time model, will be the filtration generated by the stochastic processes (usually a brownian motion, ), based on the model’s […]

[…] Introduction to Brownian Motion […]